Purchasing an automobile, new or secondhand, is a thrilling accomplishment.. However, it also comes with significant financial planning. Understanding your monthly payments is crucial to avoid stress and stay within budget. This is where a car loan EMI calculator becomes essential.

A car loan EMI calculator helps you instantly check your monthly installment for any car loan, giving clarity on your financial obligations and helping you plan effectively. In this guide, we’ll cover everything—from new and used car loans to specialized calculators like the Bob car loan’s EMI calculator and old car loan’s EMI calculator.

WHAT IS A CAR LOAN EMI CALCULATOR?

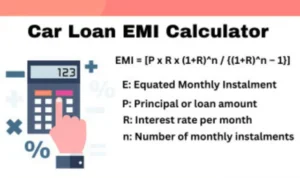

A car loan’s EMI calculator is an online tool that calculates your Equated Monthly Installments (EMIs) automatically. Traditional manual calculations can be complex, but with a calculator, you can input your loan amount, interest rate, and tenure to see exactly how much you’ll pay each month.

Key factors considered by a car loan’s EMI calculator:

- Loan Amount (Principal): Total money borrowed from the bank.

- Interest Rate: Annual interest applied to your loan.

- Loan Tenure: The amount of time needed to repay the loan.

Using a calculator eliminates errors, saves time, and gives you a clear picture of your monthly payments, total interest, and total repayment.

WHY USE A CAR LOAN EMI CALCULATOR?

A car loan’s EMI calculator offers multiple advantages:

- Instant Calculation: Get EMI figures in seconds.

- Budget Planning: Know exactly how much to set aside each month.

- Loan Comparison: Compare different loans based on tenure and interest rate.

- Financial Clarity: Avoid hidden costs and surprises.

- Time-Saving: No need for manual math or spreadsheets.

Whether buying a new car, financing a used vehicle, or refinancing an existing loan, an EMI calculator is a must-have tool.

CAR LOAN EMI CALCULATOR FOR NEW CARS

For new car purchases, loan amounts tend to be higher, but banks often provide competitive interest rates. Using a car loan’s EMI calculator for a new car allows you to see:

- Monthly EMI

- Total interest payable

- Total payment over the loan tenure

Example: Buying a ₹10,00,000 car at 9% annual interest for 60 months results in an EMI of approximately ₹20,762. By adjusting tenure or down payment, you can reduce your EMI to a comfortable level.

USED CAR LOAN EMI CALCULATOR

Financing a used car comes with different conditions compared to a new car. Loan amounts may be smaller, but interest rates can be higher, and loan tenures shorter. A used car loan’s EMI calculator helps you:

- Estimate your monthly payment for pre-owned cars

- Compare different loan offers

- Plan down payments and tenure effectively

This ensures accurate financial planning for pre-owned car purchases.

BOB CAR LOAN EMI CALCULATOR

The Bob car loan’s EMI calculator is a specialized tool offered by Bank of Baroda. It provides:

- Instant calculation of monthly EMI

- Comparison of different interest rates and tenures

- Total interest and total payment display

This calculator is especially useful for borrowers who want clear numbers before visiting the bank and deciding on a loan.

OLD CAR LOAN EMI CALCULATOR

If you already have a car loan, an old car loan’s EMI calculator can be very helpful. It calculates EMIs for ongoing loans based on:

- Remaining principal amount

- Remaining tenure

- Applicable interest rate

Benefits:

- Track your existing loan payments easily

- Plan for prepayments to save on interest

- Evaluate refinancing options

SAMPLE EMI CALCULATION TABLE

| Loan Amount (₹) | Interest Rate (%) | Tenure (Months) | Monthly EMI (₹) | Total Interest (₹) | Total Payment (₹) |

| 5,00,000 | 9.5 | 60 | 10,450 | 1,27,000 | 6,27,000 |

| 7,00,000 | 9.0 | 72 | 12,300 | 1,17,600 | 8,17,600 |

| 10,00,000 | 8.5 | 84 | 15,200 | 2,76,800 | 12,76,800 |

FACTORS AFFECTING CAR LOAN EMI

Several factors influence your EMI:

- Loan Amount: Higher loan → higher EMI

- Interest Rate: Even 0.5% increase can impact EMI significantly

- Loan Tenure: Longer tenure → lower EMI but higher total interest

- Down Payment: Larger down payment → lower EMI

- Processing Fees: Can slightly increase EMI

- Prepayment Options: Reduce interest and EMI if allowed

TIPS FOR CHOOSING THE RIGHT CAR LOAN

- Compare multiple lenders to get the best interest rate

- Check for hidden charges like processing fees

- Decide tenure wisely balancing EMI and total interest

- Consider higher down payment to reduce EMI

- Use a car loan’s EMI calculator to check monthly payments

- Look for bank offers or discounts

ADVANTAGES OF DIFFERENT EMI CALCULATORS

Smart Car Loan EMI Calculator

- Fast, accurate, works for new and used cars

Used Car Loan EMI Calculator

- Tailored for pre-owned vehicles, handles higher interest rates

Bob Car Loan EMI Calculator

- Instant EMI calculation for Bank of Baroda customers

Old Car Loan EMI Calculator

- Tracks existing loans, helps plan prepayment and refinancing

FAQs

Q1: What is a car loan EMI?

Ans: EMI (Equated Monthly Installment) is the fixed monthly payment you make to repay your car loan.It includes both principal and interest and remains consistent throughout the loatenure.

Understanding EMI helps in planning your monthly budget effectively.

Q2: How does a used car loan EMI calculator work?

Ans: A used car loan EMI calculator calculates monthly installments for pre-owned vehicles.

It takes into account the loan tenure, interest rate, and loan amount.This helps buyers estimate monthly payments and plan finances efficiently.

Q3: Can I adjust my EMI later?

Ans:Yes, many banks allow EMI adjustments through tenure extension or prepayment.

You can increase or decrease EMI depending on your financial situation.This flexibility ensures better financial management during the loan period.

Q4: What is a Bob car loan EMI calculator?

Ans: It is an online tool provided by Bank of Baroda for instant EMI calculations.The tool works for both new and used cars.It shows monthly payments, total interest, and overall loan repayment clearly.

Q5: How does an old car loan EMI calculator help?

Ans: It calculates EMIs for existing loans based on remaining principal and tenure.It helps track outstanding payments and plan prepayments.This ensures better management of your ongoing car loan.

Q6: Does down payment affect EMI?

Ans:Yes, a higher down payment reduces the loan principal and monthly EMI.It also decreases the total interest payable over the loan tenure.This allows borrowers to manage finances more comfortably.

Q7: Can I compare multiple loans using an EMI calculator?

Ans: Absolutely, EMI calculators allow comparison of different loan amounts, tenures, and interest rates.This helps in selecting the most affordable and suitable loan.It simplifies the decision-making process for car buyers.

Q8: Are there any hidden charges affecting EMI?

Ans: Some banks may include processing fees, late payment charges, or prepayment penalties.

These charges can slightly increase your monthly EMI.

Using an EMI calculator helps account for such charges in advance.

CONCLUSION

A car loan EMI calculator is essential for anyone planning to buy a car or manage an existing loan. Using tools like used car loan EMI calculator, Bob car loan EMI calculator, or old car loan EMI calculator provides:

- Clear insight into monthly payments

- Ability to compare multiple loan options

- Planning for down payments and tenure

- Avoiding financial surprises

Start using a car loan EMI calculator today and take control of your car financing journey. With accurate EMI calculations, budgeting becomes easier, and your dream car becomes more affordable.