Wealth creation is rarely a one-time event. Rather, it is the result of time, consistency, and strategic financial decisions, anchored by a mathematical principle that Albert Einstein famously called the “Eighth Wonder of the World”: compound interest. For anyone starting their first job, planning for retirement, or building an investment portfolio in 2025, understanding how money grows over time is essential. A compound interest calculator is not just a tool—it is a roadmap to financial freedom, allowing you to visualize how consistent savings today can create significant wealth tomorrow.

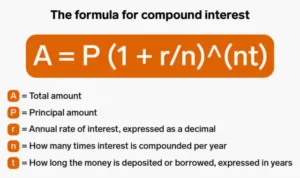

The principle behind compounding is simple but powerful: you earn interest on your interest. Unlike simple interest, which only calculates returns on your initial investment, compound interest reinvests your earnings, allowing your balance to grow exponentially over time. In today’s world of volatile markets and rising inflation, a reliable compound interest calculator is an indispensable asset to project savings accurately and make informed financial decisions.

What is a Compound Interest Calculator?

A compound interest calculator is a digital tool that helps you estimate the future value of your investments or savings by taking into account the principal amount, interest rate, compounding frequency, and investment period. Using this calculator, you can:

- Predict how your wealth will grow over time

- Plan for retirement or large expenses

- Compare investment strategies and interest rates

- Visualize the effect of regular contributions or withdrawals

In 2025, these calculators are more sophisticated than ever, incorporating inflation adjustments, tax considerations, and variable interest rates, making financial planning precise and actionable.

How Compound Interest Works

The true magic of a compound interest calculator lies in its ability to illustrate exponential growth. Consider this example:

- Principal: $1,000

- Interest Rate: 5% annually

- Compounding: Monthly

| Year | Simple Interest | Compound Interest |

| 1 | $50 | $50.00 |

| 2 | $100 | $102.50 |

| 5 | $250 | $276.28 |

| 10 | $500 | $628.89 |

Notice how compound interest accelerates wealth growth over time. Even small investments can snowball into substantial sums, especially when combined with monthly contributions and early investing.

Why Time is Your Greatest Asset

Time is the most critical factor in compounding. The earlier you start investing, the more opportunity your money has to grow. A compound interest calculator highlights this “cost of delay,” showing the difference between starting at age 20 versus age 40.

Example: Monthly Contributions of $200

| Age Started | Amount at 65 (8% annual) |

| 20 | $1,001,000 |

| 40 | $480,000 |

Starting early allows decades of growth, where interest builds on interest, leading to dramatic wealth accumulation.

Maximizing Returns with Regular Contributions

While a lump sum is a strong starting point, the power of a compound interest calculator is most evident when you factor in periodic contributions. Consistent monthly additions—known as dollar-cost averaging—can significantly boost your portfolio.

Example: Extra $100/month investment

- Initial investment: $5,000

- Interest Rate: 7% annually

- Period: 30 years

Future Value: $128,000

Small, consistent contributions compound alongside your initial principal, transforming minor daily sacrifices into substantial long-term wealth.

The Impact of Interest Rates and Inflation

Not all interest rates are equal. Understanding nominal vs. real interest is crucial. For example, a 4% return during 3% inflation gives a real growth rate of only 1%.

A compound interest calculator allows you to test scenarios:

- Stock market returns (6%-10%)

- High-yield savings accounts (3%-5%)

- Inflation-adjusted outcomes

This helps you plan realistically and align your investment strategy with personal goals.

Tax-Advantaged Accounts and Compounding

Compounding is most powerful in tax-sheltered accounts like 401(k)s or Roth IRAs. Taxes can erode your gains in regular brokerage accounts. Using a compound interest calculator, you can see the difference:

- Pre-tax growth vs. post-tax growth

- Retirement account advantage

- Impact of tax-free withdrawals

In 2025, maximizing tax efficiency ensures that your compounded returns remain intact, significantly increasing your final wealth.

Common Pitfalls to Avoid

Even the most disciplined investor can derail compounding by:

- Interrupting contributions: Any withdrawal reduces future interest potential

- High fees: Active funds with high management fees can consume 25%-30% of wealth over decades

- Market timing mistakes: Trying to outguess markets can reduce long-term growth

A compound interest calculator helps you visualize these pitfalls, emphasizing the importance of consistency and low-cost investing.

Strategies for Different Life Stages

20s and 30s: Time in the Market

- Focus on high-growth investments

- Maximize principal contributions early

- Let compounding work over decades

40s and 50s: Peak Earnings

- Increase contributions

- Consider catch-up contributions for retirement

- Balance growth with moderate risk

60s and Beyond: Preservation

- Shift toward income-generating and low-risk assets

- Continue compounding where possible

- Prioritize liquidity and stability

A compound interest calculator helps tailor strategies at each life stage for maximum wealth accumulation.

The Psychology of Long-Term Investing

Humans prefer instant gratification, but compounding rewards patience. Visual tools in a compound interest calculator provide motivation, showing the exponential growth curve that starts slow but eventually skyrockets. This psychological reinforcement encourages disciplined, long-term investing.

Advanced Features in 2025 Calculators

Modern calculators include:

- Variable interest rates: Simulate market fluctuations

- Inflation adjustments: Estimate real purchasing power

- Tax considerations: Calculate pre-tax vs. post-tax outcomes

- Visual graphs: See contributions vs. interest growth over time

Using these tools creates a financial twin, a digital model to optimize decisions like career changes, savings increases, or retirement age adjustments.

Real-Life Examples

- Small Investments Matter: $50/month over 40 years at 8% = $172,000

- Early vs. Late Investing: Starting at 25 vs. 35 with same contributions = $100,000 difference

- High-Yield vs. Low-Yield: 12% vs. 5% annual growth dramatically alters retirement savings

A compound interest calculator makes these numbers tangible, reinforcing the importance of early action and smart strategy.

FAQs

Q1: What is the difference between simple and compound interest?

A: Simple interest is calculated only on your initial principal. Compound interest grows on both the principal and accumulated interest, allowing your money to grow exponentially.

Q2: How often should interest be compounded?

A: More frequent compounding—daily or monthly—is better than annual compounding. However, the interest rate and duration of investment are more critical factors.

Q3: Can I use a compound interest calculator for debt?

A: Yes. Compounding works against you with debt, such as credit cards. Calculators help visualize how minimum payments impact total interest owed.

Q4: What interest rate should I use for projections?

A: High-yield savings accounts: 3%-5%

Stock market portfolios: 7%-8% conservatively

Inflation-adjusted returns: subtract 2%-3% from expected gains

Q5: Does inflation affect my compounding?

A: Yes. Inflation reduces purchasing power. Use a compound interest calculator with inflation adjustment to see your real wealth growth.

Q6: Should I invest a lump sum or monthly contributions?

A: Both. Lump sum compounds immediately, while monthly contributions maintain discipline and leverage dollar-cost averaging.

Q7: When does compound interest “take off”?

A: Usually after 15-20 years. Interest earned often exceeds the sum of your contributions, creating exponential growth.

Q8: How do taxes impact compounding?

A: Taxes on dividends and capital gains reduce your effective growth. Tax-advantaged accounts like Roth IRAs allow compounding without this drag.

Q9: Can I use a compound interest calculator for retirement planning?

A: Absolutely. It’s a vital tool to estimate savings needs, growth rates, and retirement income, making projections realistic.

Q10: Is it too late to start investing?

A: Never. While early investing maximizes compounding, starting later with higher contributions still grows wealth effectively.

Conclusion

Wealth is not accidental—it is the result of disciplined saving, smart investing, and the exponential power of compound interest. A compound interest calculator bridges your present financial situation with your future goals, transforming abstract numbers into tangible outcomes.

The earlier you start, the more you contribute, the more disciplined you are, and the lower your fees, the greater your eventual wealth. In 2025, whether for retirement, investment portfolios, or savings, the principles of compounding remain a timeless path to financial security.